According to an industry survey, after the power generation industry, the cement, steel and electrolytic aluminum industries are expected to be included in the national carbon market by 2023. The carbon price in the national carbon market will also rise steadily, which is expected to rise from 49 yuan / ton in 2022 to 87 yuan / ton in 2025.

The survey was jointly conducted by international consulting firm ICF and Beijing Zhongchuang carbon investment Technology Co., Ltd. Lin Lishen, chief analyst of Zhongchuang carbon investment, introduced that the investigators collected 417 questionnaires from stakeholders in different industries, of which 76% came from emission control enterprises and 49% from enterprises that have been included in the regional or national carbon market.

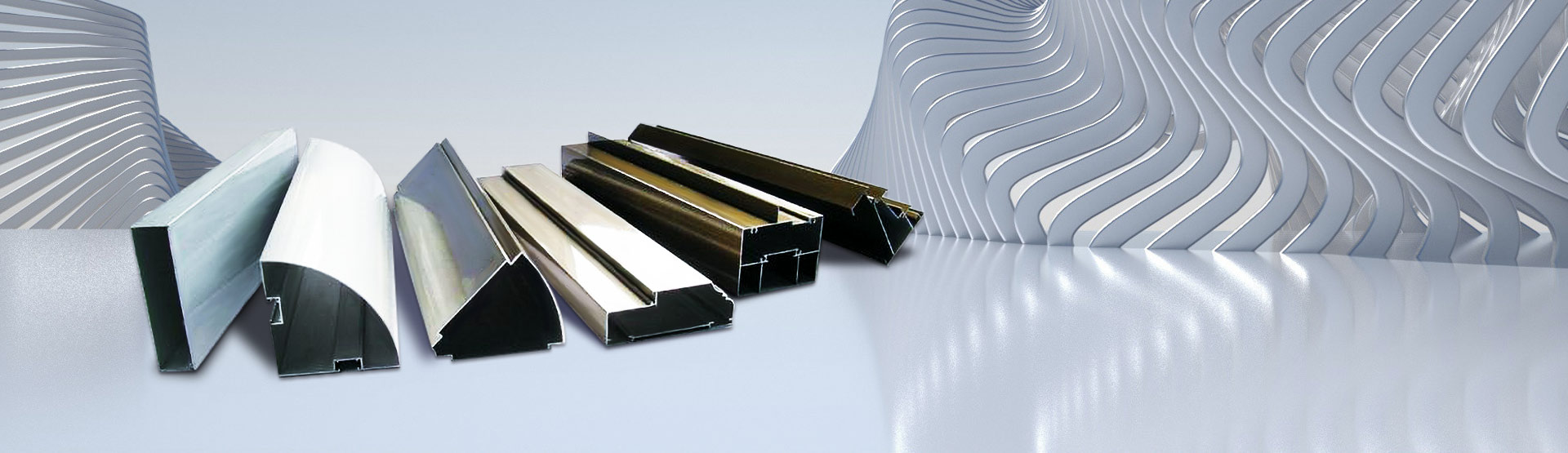

Among the emission control enterprises, the power generation industry accounts for a high proportion (33% of respondents), followed by the construction materials industry, including cement (20%), steel (7%), chemical industry (6%) and non-ferrous metals (5%). 10% of the respondents are from carbon market related service providers, including consulting services, verification services, carbon offset project development and carbon trading services, and 3% are from research institutions. Other respondents came from academia, the financial industry and local governments.

The survey results show that respondents expect the carbon price in the national carbon market to rise steadily, but there are great differences in the expectation of the rise range. The average carbon price in the national carbon market in 2022 is expected to be 49 yuan / ton, which will rise to 87 yuan / ton by 2025 and 139 yuan / ton by 2030.

The survey found that the cement, steel and electrolytic aluminum industries are relatively more fully prepared to be included in the carbon market. Most respondents believe that these three industries will be included in the national carbon market before 2023, while more than one third of respondents expect the above three industries to be included as early as 2022. The average estimated time for petrochemical, papermaking, chemical, aviation and other key emission industries to be included in the national carbon market is before 2024.

In response to the quota allocation of their enterprises in the national carbon market within a performance period, about half of the respondents in the power industry said that there would be residual quotas after meeting the performance needs.

Respondents expect that from now until 2030, the impact of carbon prices on investment decisions will increase day by day. About four fifths of the respondents who answered the question expected that the investment decisions of their enterprises would be at least moderately affected by 2025. Only 5% of respondents who answered this question expected that the investment decisions of their enterprises would not be affected even by 2025.

An interviewee from a power generation enterprise in Yunnan said that China's national carbon emission trading system will affect the implementation of the enterprise's energy planning. "From 2021 to 2025, we will gradually promote energy transformation. From 2025 to 2030, we will start a new round of energy transformation, phase out large carbon emission equipment and shift to clean energy development. We will complete the transformation and business development from 2030 to 2050." Respondents said.

When asked what data needs to be published to enhance the transparency of the market, most respondents believe that the important data are the annual emission data of enterprises, industrial emission data, quota allocation and enterprise performance.

An interviewee from a chemical enterprise in Shanghai said that high fines and third-party verification should be used at the same time. If there is no verification, there is no objective evaluation standard for fines. Without high fines, verification and results will be meaningless.